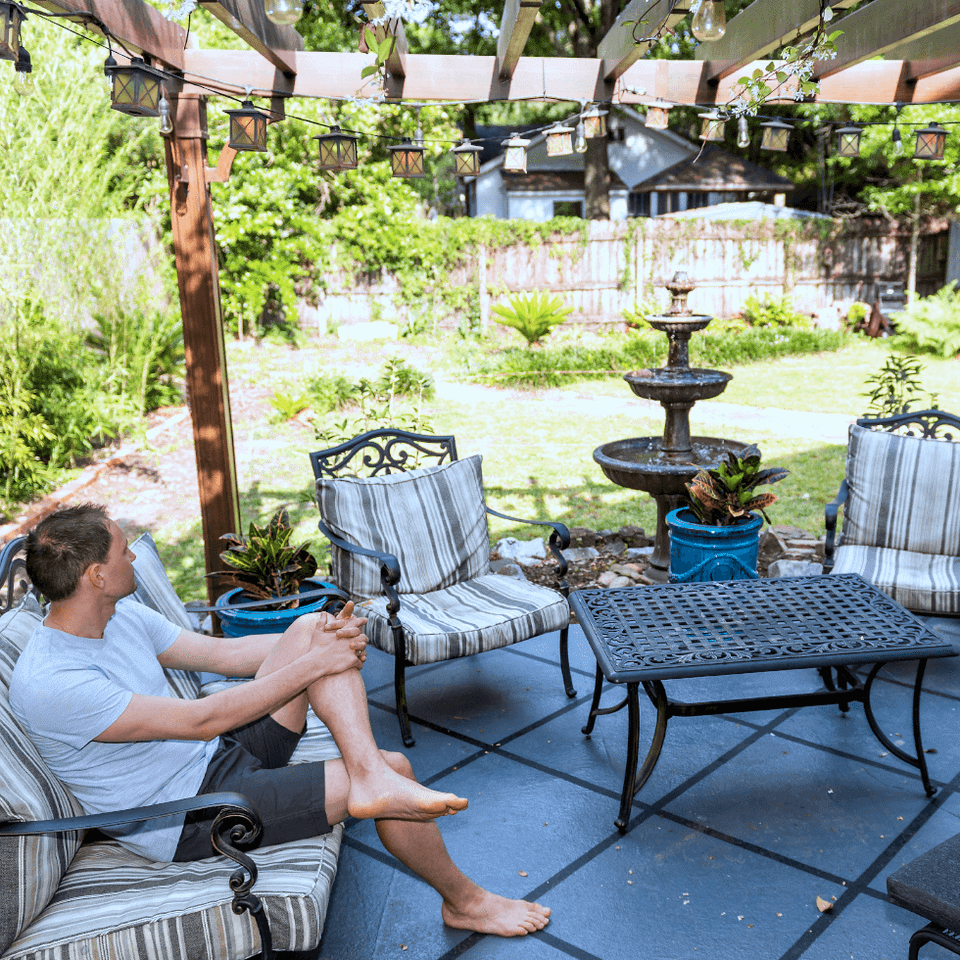

Home and property coverage

A homeowners policy is insurance to pay for damage to your home caused by lightning, fire, wind, hail, tornadoes, and other disasters listed in your policy. Some common exclusions are flood, earthquake, or routine wear and tear. Some water damage (like rain coming in a broken window) could be covered, but flood insurance is covered under a separate policy. The most important part of a homeowners policy is to cover your home for what it would cost to rebuild and not for how much you could sell it for or what you paid for the home.

- Get coverage in case of damage from natural disasters and storms

- Flood coverage is available in a separate policy

- Coverage amount is based on the cost to rebuild or replace