Life

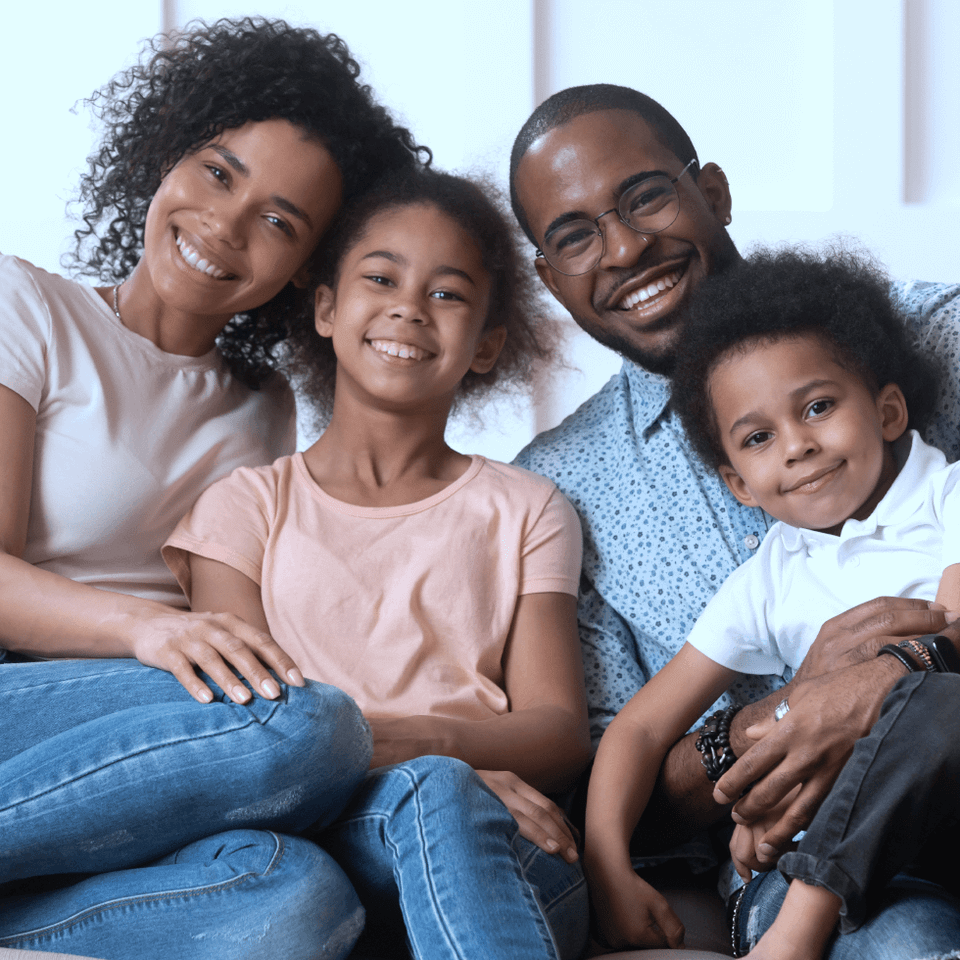

Take care of those who matter most

It is common for people to put off discussions of life insurance because death is an uncomfortable topic. Grief is a heavy burden for your loved ones, and you don't want to add a financial burden to that load. Buying life insurance can be simple and affordable so that you know your family is taken care of.

Term life policies

Whole life policies

Universal life policies

Whatever type of insurance you choose, you can specify amounts of coverage to

cover final expenses and provide for the future of your loved ones.

cover final expenses and provide for the future of your loved ones.

What is life insurance?

Life insurance is an important safety net for those that depend on you financially. The payout to your beneficiaries, like your spouse or children, can pay any mortgage debt, replace your income, or pay for college tuition.

There are several types of life insurance products to meet your needs at any stage in life:

Everyone's insurance needs are different. Evaluating your financial position and determining the needs of your beneficiaries will help you find the right coverage. Our insurance experts can provide you with a FREE life insurance quote.

There are several types of life insurance products to meet your needs at any stage in life:

- Term life insurance: This policy covers a limited time frame like 10, 20, or 30 years and accrues no cash value. The cost is affected by age and health history.

- Whole life insurance: This is a permanent life insurance policy that stays in effect so long as the premiums are paid. It can sometimes accrue cash value to be accessed before your death.

- Universal life insurance: This coverage is similar to a whole life policy but offers more flexibility for payments, coverage amounts, and the rate at which you want to build cash value.

Everyone's insurance needs are different. Evaluating your financial position and determining the needs of your beneficiaries will help you find the right coverage. Our insurance experts can provide you with a FREE life insurance quote.

Is life insurance taxable?

Life insurance payouts to your beneficiaries are tax-free. However, you do have to consider taxes if you are planning to withdraw from the cash value of your policy. If you plan to withdraw funds or borrow against your cash value policy, it is wise to contact your insurance provider and understand which amounts are taxable and which are not.

Who needs life insurance?

Consider if a stay-at-home mother of two suddenly passed away. Insurance would cover the expenses of services she did for free, like child care. It could also pay for unexpected funeral costs that were not set aside beforehand.

A number of people should consider life insurance, especially those like:

Any individual concerned about paying for funeral expenses can purchase a small life insurance policy to cover their funeral, burial, and other final expenses.

A number of people should consider life insurance, especially those like:

- Breadwinners

- Homeowners with a mortgage

- Business owners

- Parents of special needs children

- And more

Any individual concerned about paying for funeral expenses can purchase a small life insurance policy to cover their funeral, burial, and other final expenses.

When should I buy life insurance?

It is common for some employers to offer life insurance policies for their employees. It is a good idea to accept this coverage, but it is often not enough to support your family financially after your death. If you are young and in good health, it is the perfect time to buy affordable insurance.

Life insurance is not something to be avoided and saved for consideration later in life. Death can be unexpected and insurance can provide for your loved ones in multiple ways.

If you purchase any type of life policy while you are younger and healthier, your premium payments will be less than insurance you buy later in life.

Life insurance is not something to be avoided and saved for consideration later in life. Death can be unexpected and insurance can provide for your loved ones in multiple ways.

- Cover unexpected funeral costs for children

- Pay off debt like student loans that you've cosigned

- Help a spouse or partner pay off your joint mortgage

- Replace your lost income to provide for your young family

- Finance your children's college education

- Leverage cash value policies to supplement retirement income

- Leave an inheritance for your beneficiaries

If you purchase any type of life policy while you are younger and healthier, your premium payments will be less than insurance you buy later in life.

How much insurance do I need?

When purchasing life insurance, consider the type of coverage your family will need in the event of your death. Will they need to replace your income or continue to pay a mortgage? Do you want to pay for college for your children?

Some policies are guaranteed to issue coverage up to a certain amount and others require a medical exam for higher amounts of coverage.

Our professional agents can help you adjust your coverage amounts and then consider the products and services of multiple life insurance policies. Because these policies are long-term coverage, we only work with trusted companies with a high reputation for claims-paying ability.

Some policies are guaranteed to issue coverage up to a certain amount and others require a medical exam for higher amounts of coverage.

Our professional agents can help you adjust your coverage amounts and then consider the products and services of multiple life insurance policies. Because these policies are long-term coverage, we only work with trusted companies with a high reputation for claims-paying ability.

Do you have a question

about Life Insurance?

Our agents are ready to answer any of your questions.